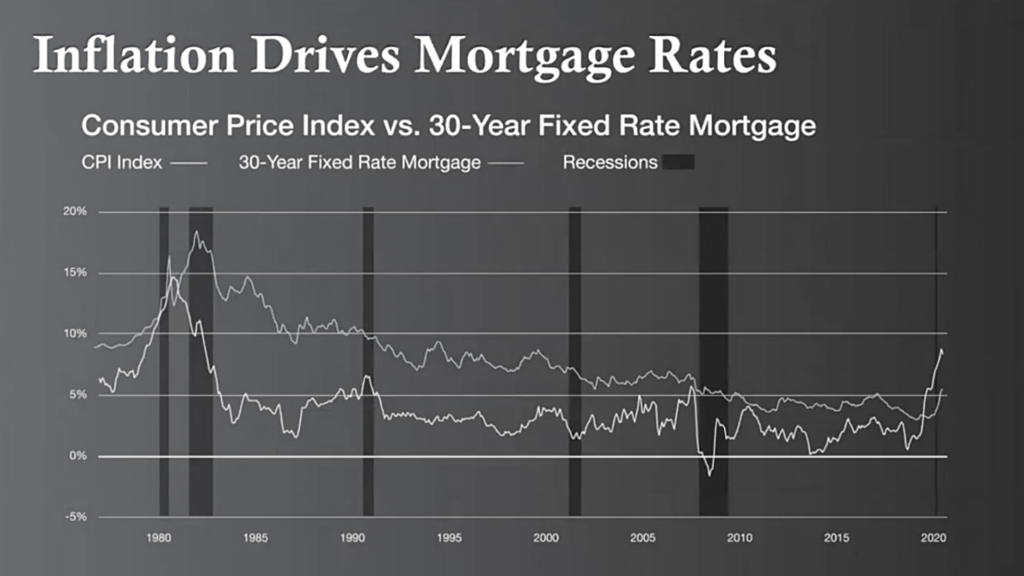

First, let’s talk about rates: Why have they gone up?

Well…the FED artificially kept them low during the pandemic to spur spending. But, all good things have to come to an end. We are now in a period of high levels of inflation, and rates tend to closely follow inflation levels:

Ok, so now what?

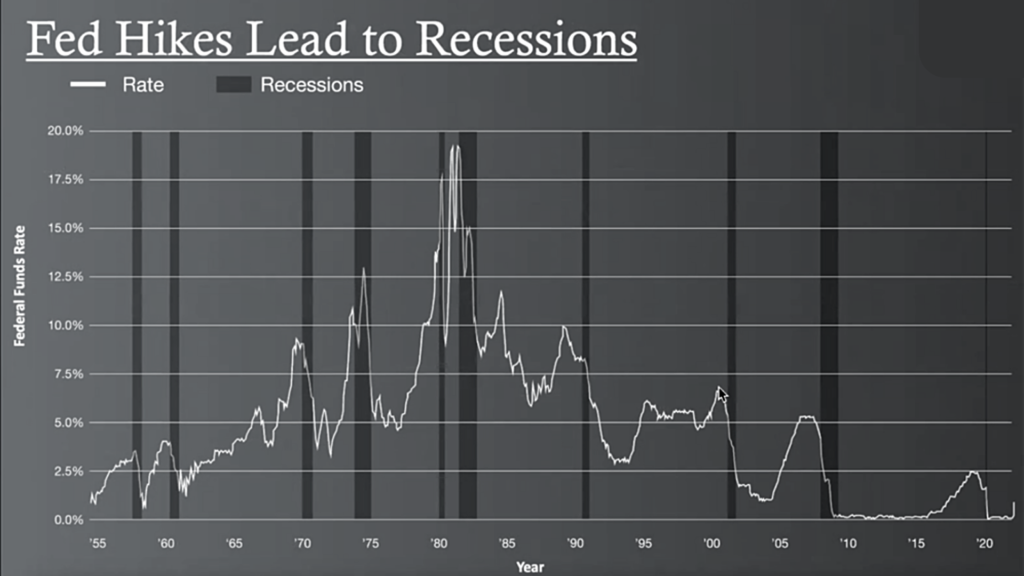

As you’ve been hearing, throughout 2022, the FED has been steadily raising rates. Turns out, rate hikes (to the degree that we’ve experienced this year) almost always lead to recessions. Case in point:

In fact, we’re technically in a (slight) recession now, even though most don’t acknowledge it. Say what?!

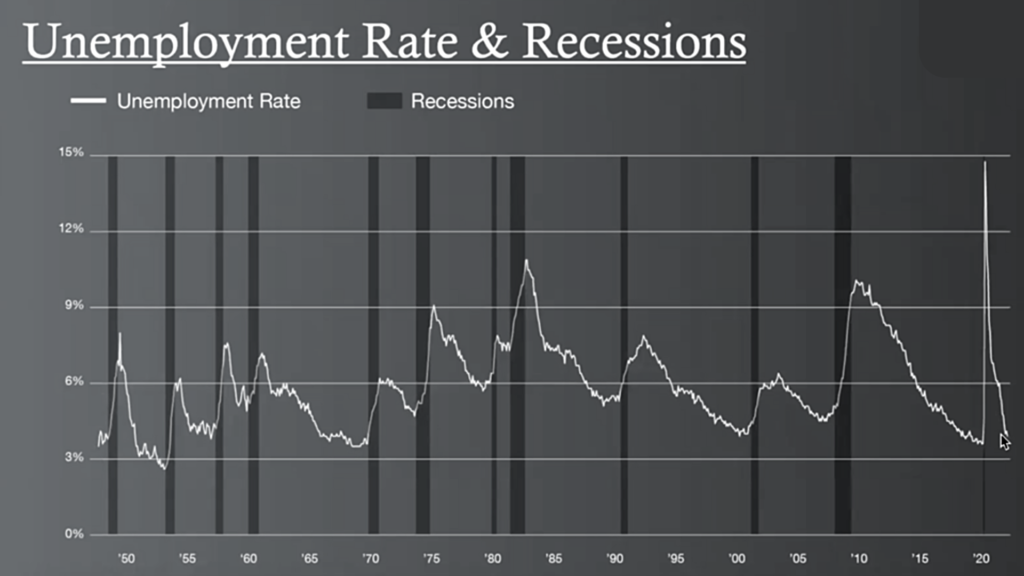

Well, the universal definition of a recession is a fall in GDP in two consecutive quarters. GDP growth for Q1 2022 declined 1.6%; and also declined 0.9% in Q2. So, technically a recession…but barely. That said, another key metric in predicting recessions is unemployment. With 100% accuracy over the last 100 years, when unemployment reaches its lowest point and then starts to tick up, a recession follows. Our administration keeps talking about how low unemployment is right now (currently ~3.5%). Well…you do the math:

So…let’s say we end up in a (more widely-accepted) recessionary period in the next few quarters…then what?

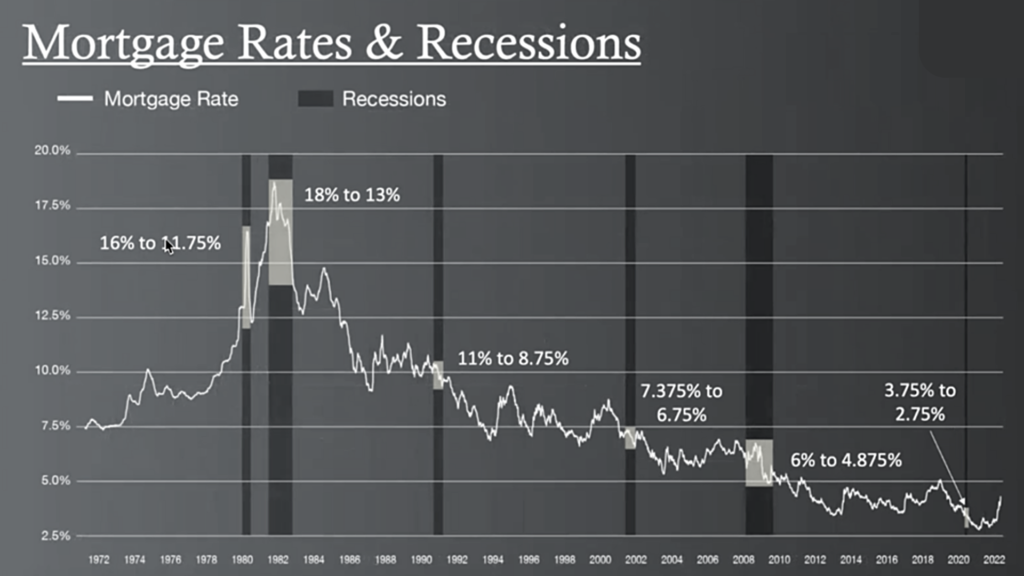

While we certainly don’t want a catastrophic recession (which is very, very unlikely), recessions can sometimes be needed to help reset things. And, they also tend to be good for the housing market. Why? Well, in recessions, mortgage rates almost always come down:

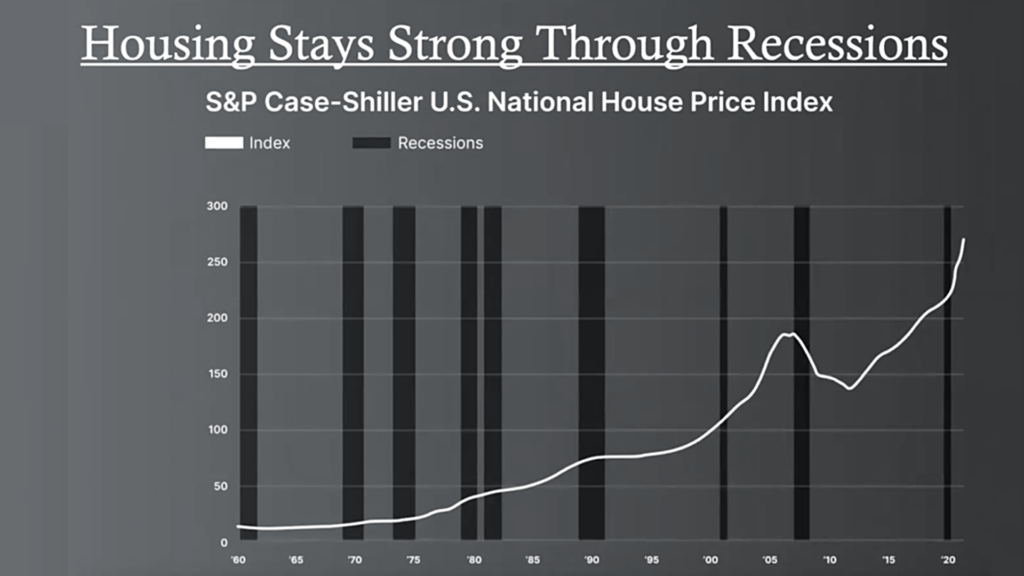

Ok…so, what?! Why does the housing market tend to stay strong in a recession?

Like we talked about earlier, lower rates spark spending (do you see the cycle?). Well, it turns out – a house is a pretty big-ticket item that also has many downstream, positive impacts on the economy. For example, after you buy that house, you also buy a new couch and hire a painter to change the color of the bedrooms.

Of course, as you can see in the graph, the main exception to everything I noted above was the recession in 2008. Read: housing crisis. Well, that was VERY different from the reality of today, so don’t worry…

So, will home prices keep going up?

Just about all of the leading sources (i.e., National Association of Realtors, Fannie Mae, Zillow, Mortgage Bankers Association, etc) believe they will. But, not by as much as the last few years (that wasn’t healthy). Yes, rates are higher now (not bad, but higher). However, they will very likely come back down sometime within the next year or so. And, with lower rates, we expect more buyers to come back to the buying table!

Have questions? Thoughts? Different perspective? I’m all ears – let’s chat!