This report will be different than others. Right now, there are two very distinct viewpoints about the future of home prices — Some think prices will continue to rise. Some think they the growth will cool down. So, who’s right? In this report, I will present you with data to support both sides, so you can draw your own conclusions.

In summary —

Argument: Prices will keep going “UP”

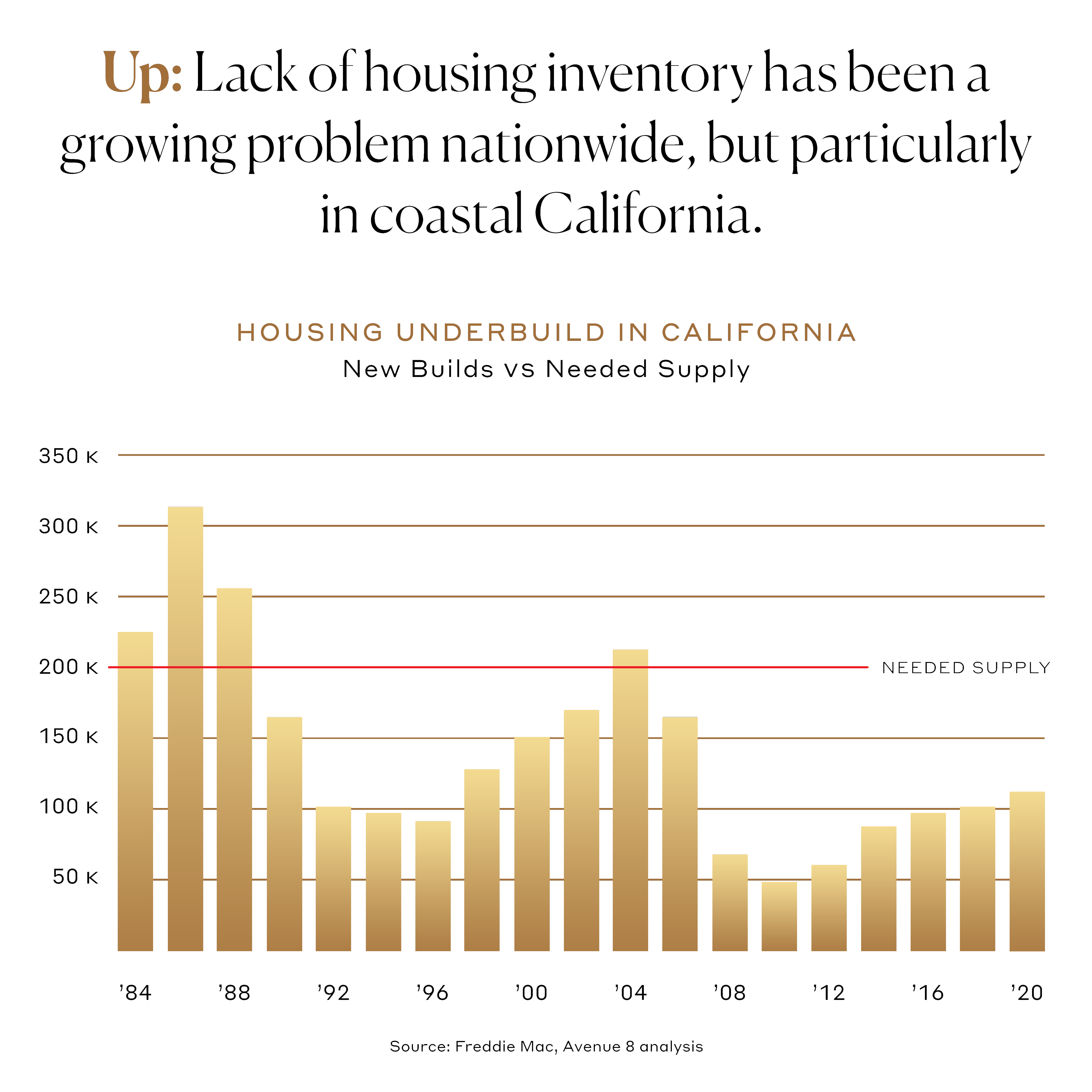

Data point #1: Across the country and particularly in CA, there is a growing supply problem, dating back to the 1990s. As the population in need of housing grows faster than builders can build, this will continue to be exasperated, leading to higher prices.

Data point #2: The number of homes in SF that have been sold/purchased in the last year has actually doubled YoY, indicating that cities are just as hot as suburbs. In fact, the number of searches for urban properties on Redfin in June has increased, and searches within the suburbs have decreased.

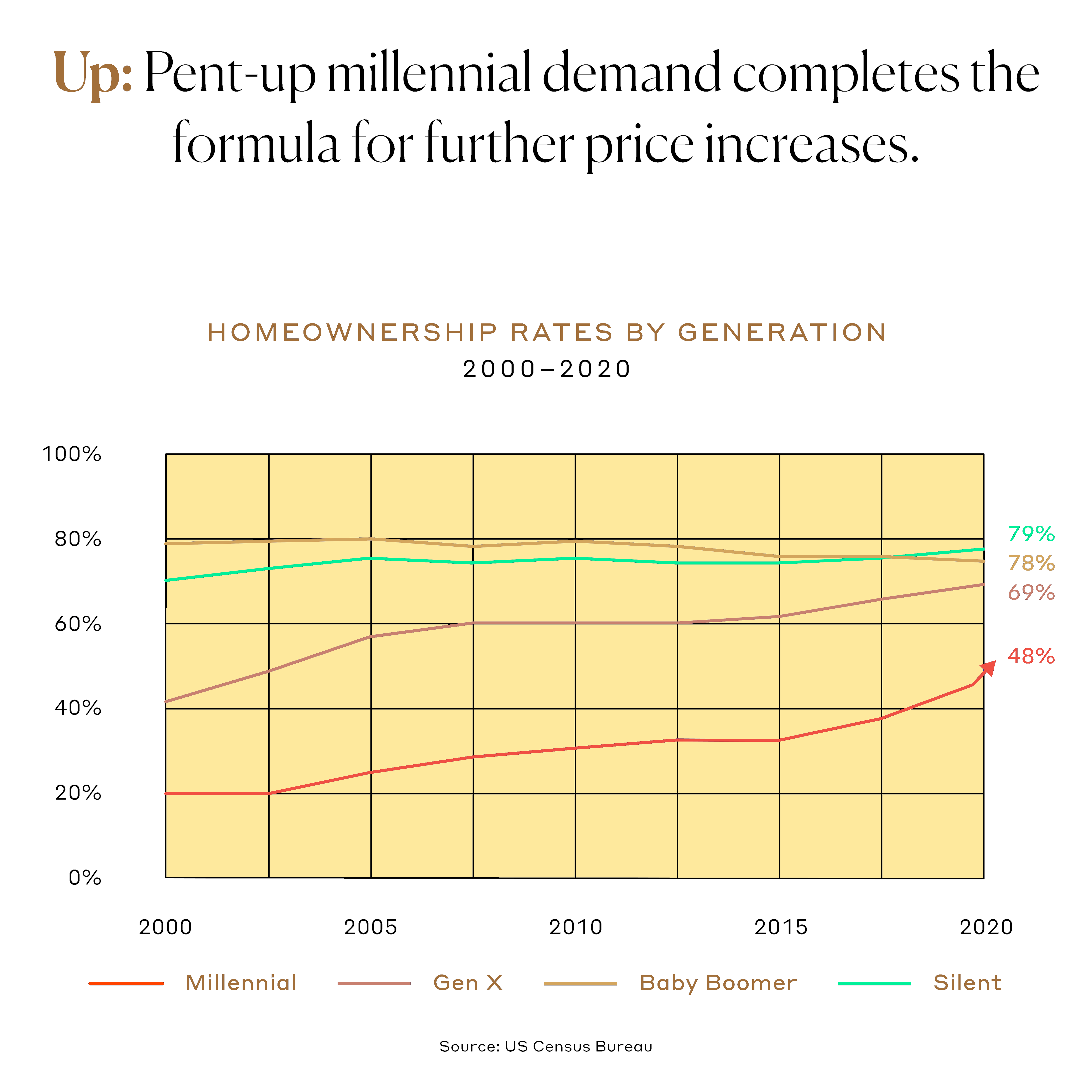

Data point #3: Millennial homeownership rates are currently the lowest of any other generation, but they have grown the fastest, as the majority of this generation moves into the prime homeownership stage of life. So, forecasts for home sales over the next few years may be understated, as the millennial homeownership rate continues to rise, just as supply remains limited.

Argument: Prices will start going “DOWN”

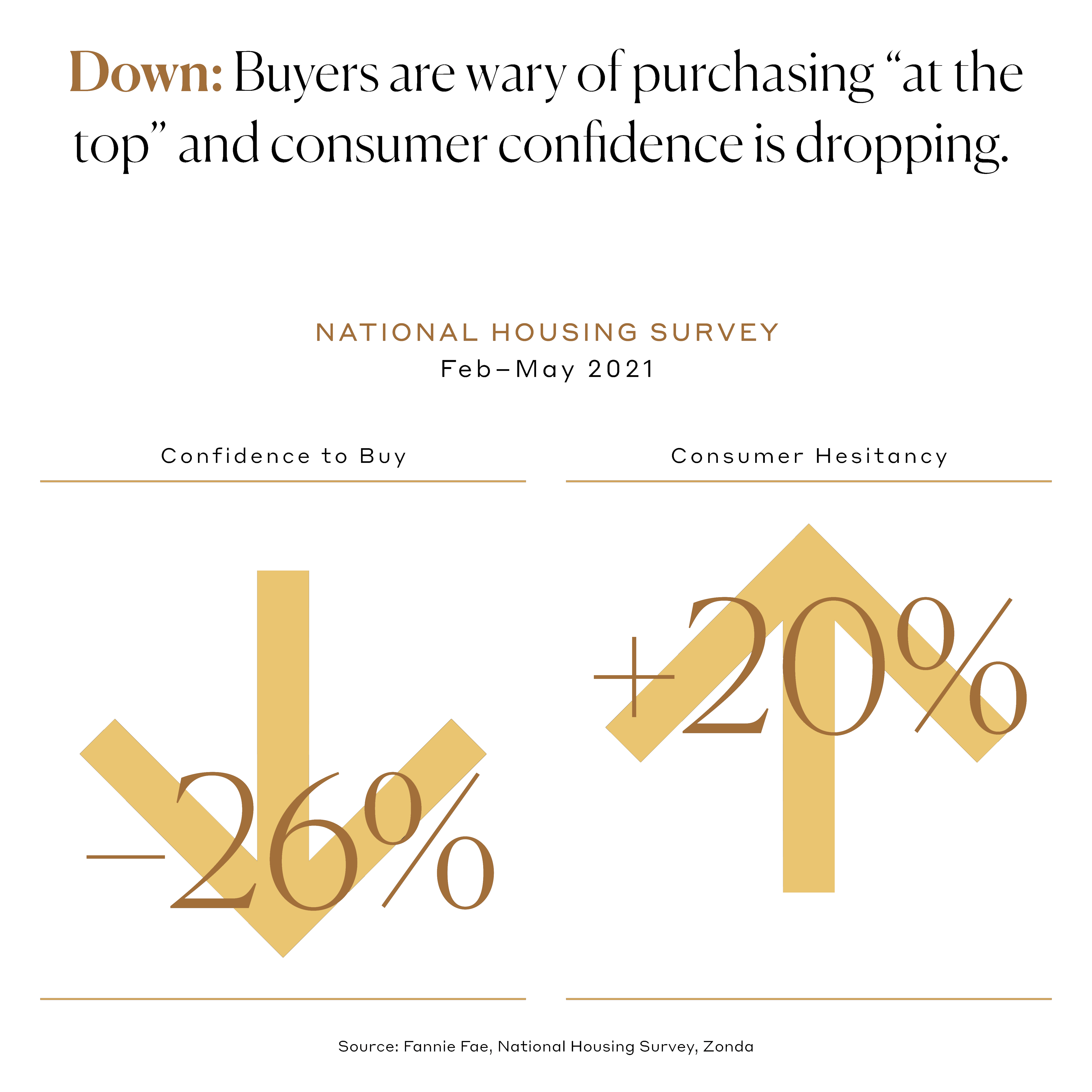

Data point #1: Consumer confidence with buying homes has started to wane for the first time since the beginning of the pandemic. People have been very gung-ho over the last several months, but some are starting to become anxious for the first time that they could be buying at the peak.

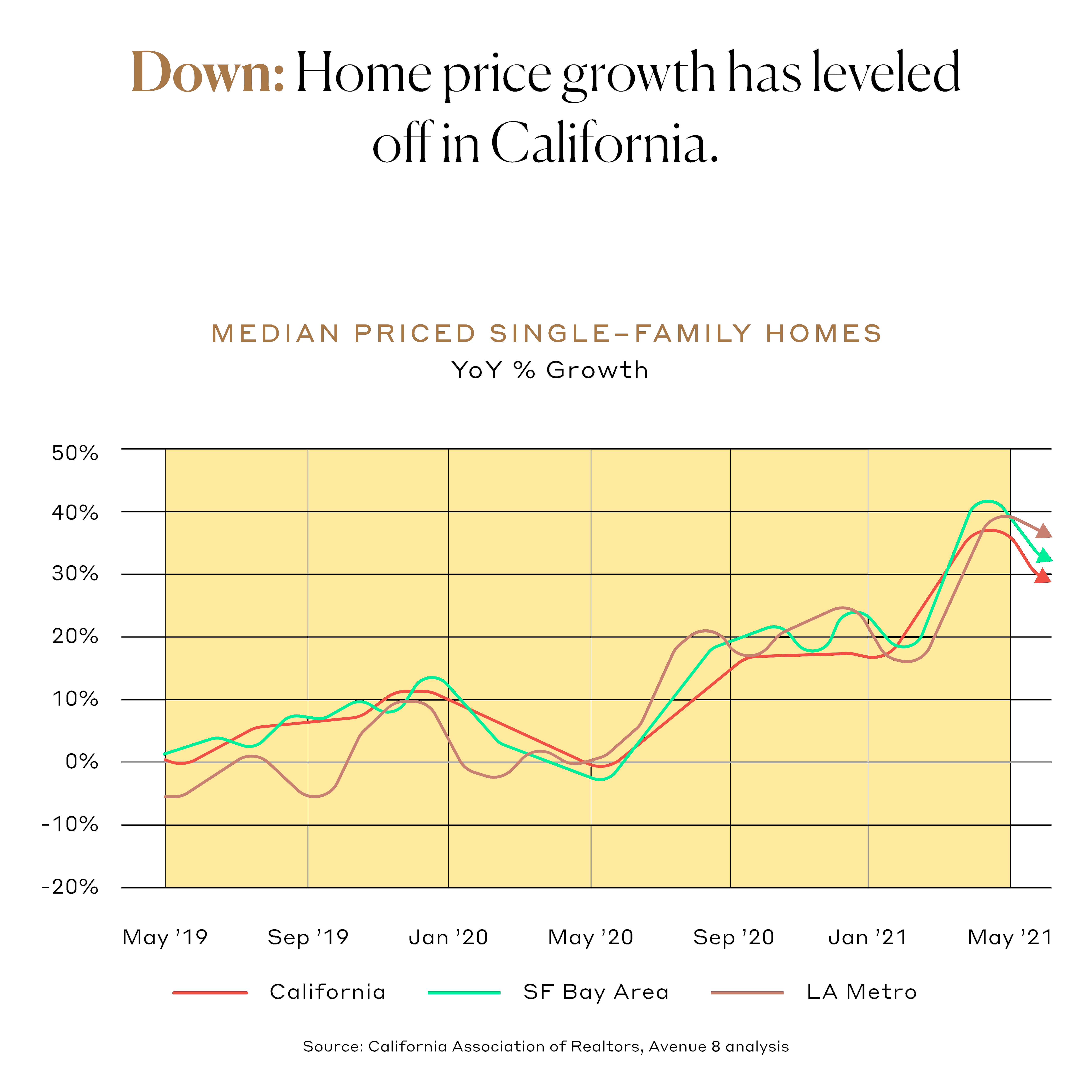

Data point #2: The price growth rate is starting to stabilize across CA. In most parts of the Bay, we have been used to crazy YoY price growth rates — i.e., 40%, depending on where exactly you are. However, on average, this is starting to level off and/or decline (i.e., from ~40% to ~32%).

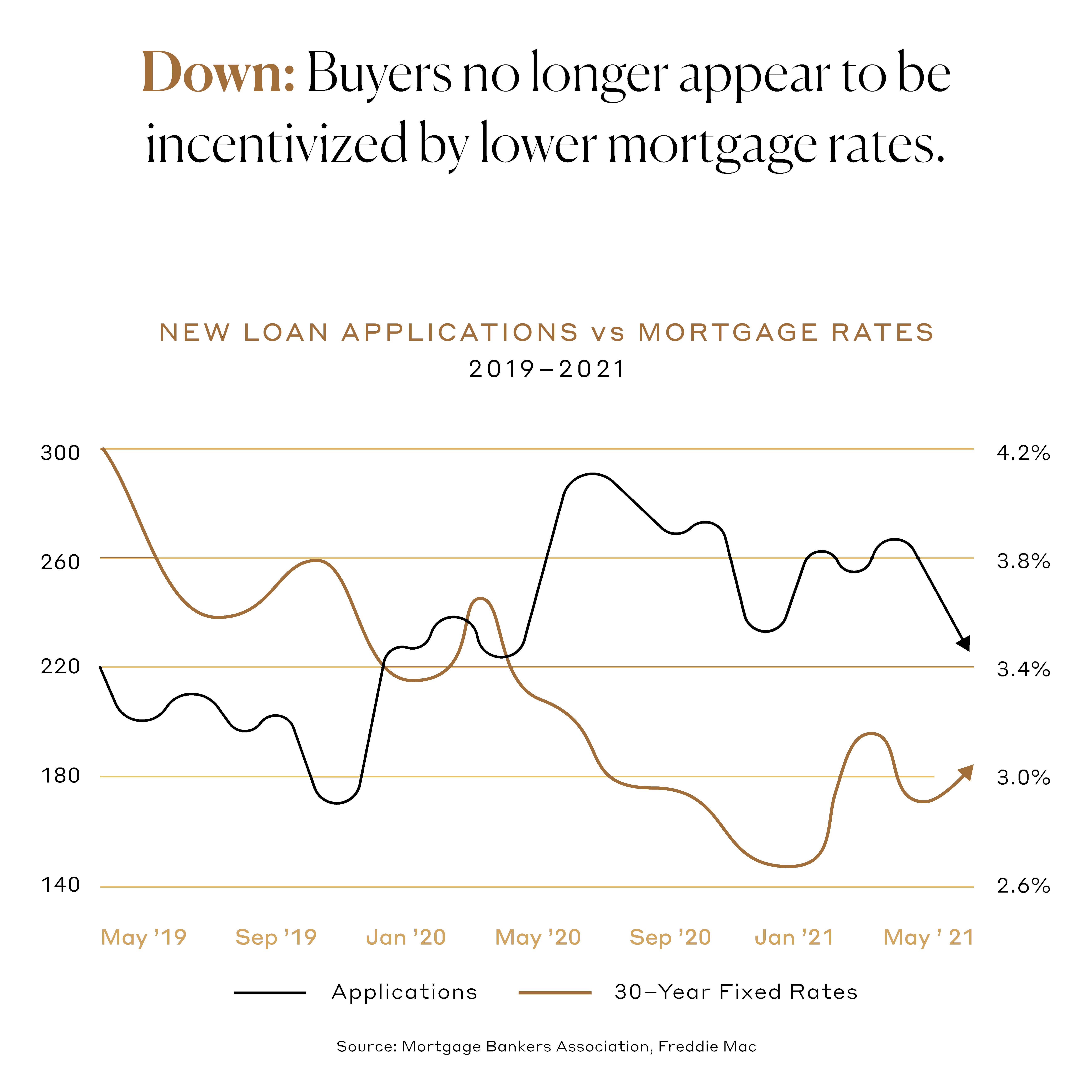

Data point #3: Buyers don’t seem to be influenced as much anymore by low interest rates. Loan applications have decreased over the past couple weeks, and it seems that the demand for homes is now driven more by supply, than rates.

Regardless of all of the above, throughout history, real estate continues to be an asset that outperforms over time.

No one has a crystal ball, but I nerd out on this type of data every day and am constantly having very informed conversations with my clients to help empower them to make smart decisions. It can absolutely be overwhelming when Googling it all on your own, so let me help you dig into this data further and synthesize it to make the best decision for you!