There’s a lot happening right now that might really shape people’s home-buying and selling journey, so this monthly update is meant to help Blake-it-down for you. So, grab your favorite beverage, find a cozy spot, and let’s dive into the latest buzz surrounding the real estate market.

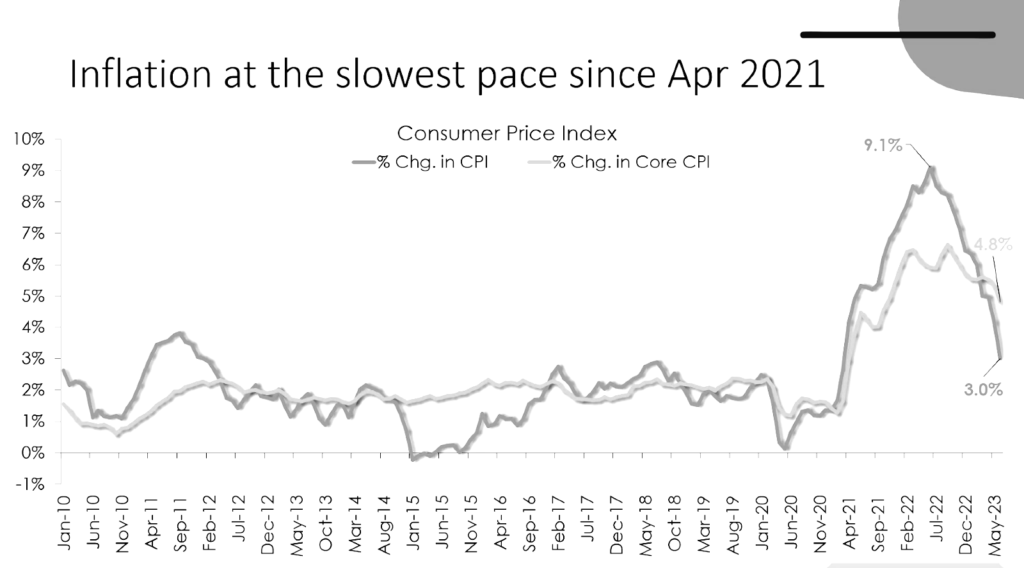

Inflation Insights: Positive Trends

The recent inflation numbers look great! Last week’s report showed a 3% inflation rate, which is a significant decline from the 9.1% rate we saw a year ago. These figures suggest a positive trajectory, and indicate that the FED rate hikes are finally working!

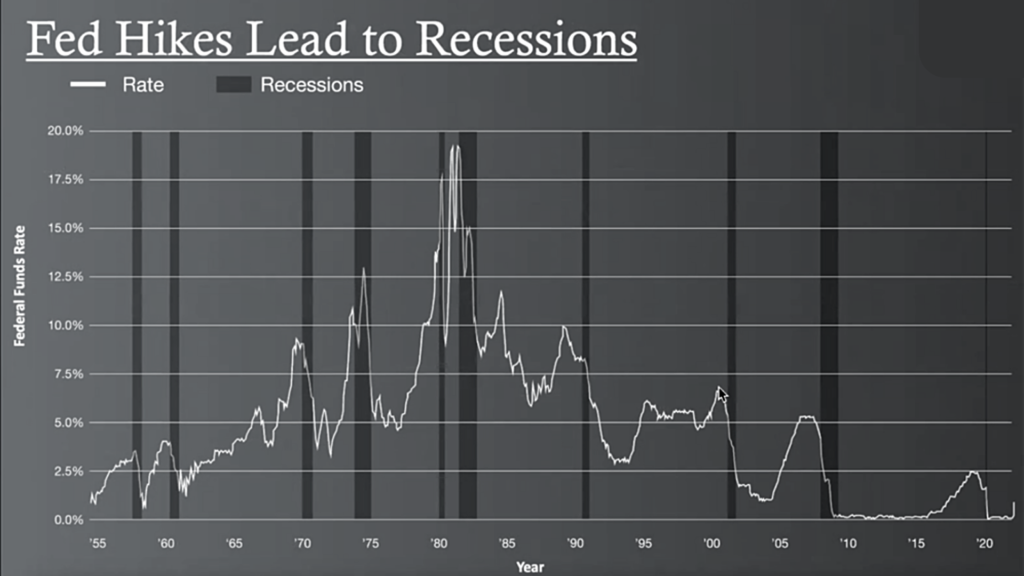

History Repeats Itself: FED Rates, Recessions, and Mortgage Rates

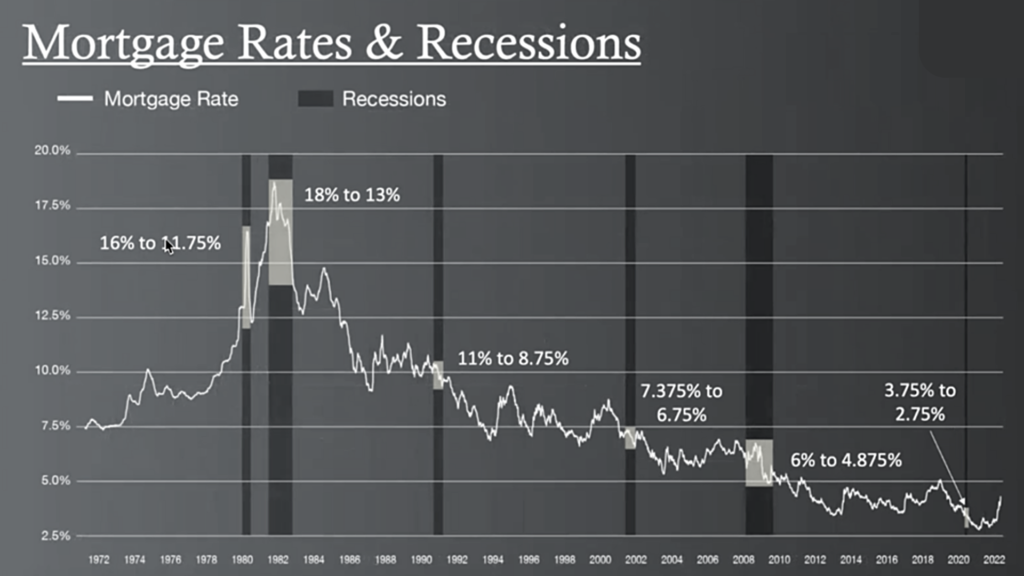

As we’ve been saying over and over, history has left us with a pretty tell-tale pattern. Here’s the pattern: FED rate hikes lead to a recession → A recession leads to lower mortgage rates → and that tends to boost the housing market.

This is true for just about every cycle in history with only a couple exceptions, including the 2008 housing crisis, which is very different from the conditions of today. So, not to sound like a broken record, but we do anticipate mortgage rates to come down later this year and/or early next year, with a little volatility in the meantime. For those who close now, this will provide a great opportunity to refinance and get an immediate discount on your home! In fact, some of our lender partners will provide you the opportunity to re-fi, free of charge – wow!

But, Something Big to Watch: Student Loan Impact

Again, FED rate hikes typically lead to a recession. And, we keep talking about that “R” word…but where is it? Well, the challenge right now is that people are still spending money. So, the economy hasn’t been pushed into a recession yet.

The foundation has been laid for this recession, but sometimes, you just need a catalyst to light the fire. On that note…an emerging factor to watch is the resumption of student loan payments. During the pandemic, President Biden implemented a pause on student loan repayments, and the recent attempt at loan forgiveness faced legal setbacks.

As a result, a considerable number of American adults—approximately 16%—will soon need to allocate around $400 per month (on average) toward their loans. This is expected to have a tangible impact on the retail markets and the overall economy.

In fact, some experts speculate that this could potentially be just the catalyst needed to push us into that recession. It’s a situation we’ll monitor closely in the coming months.

Anticipating Future Opportunities

Isn’t a recession a bad thing? Not necessarily. It’s a natural reset in the economy, and, historically, recessions are generally good for the housing market. Why? Well, if / when we officially move into that recession, then we 100% expect rates to fall. (Again, history repeats itself over and over again.)

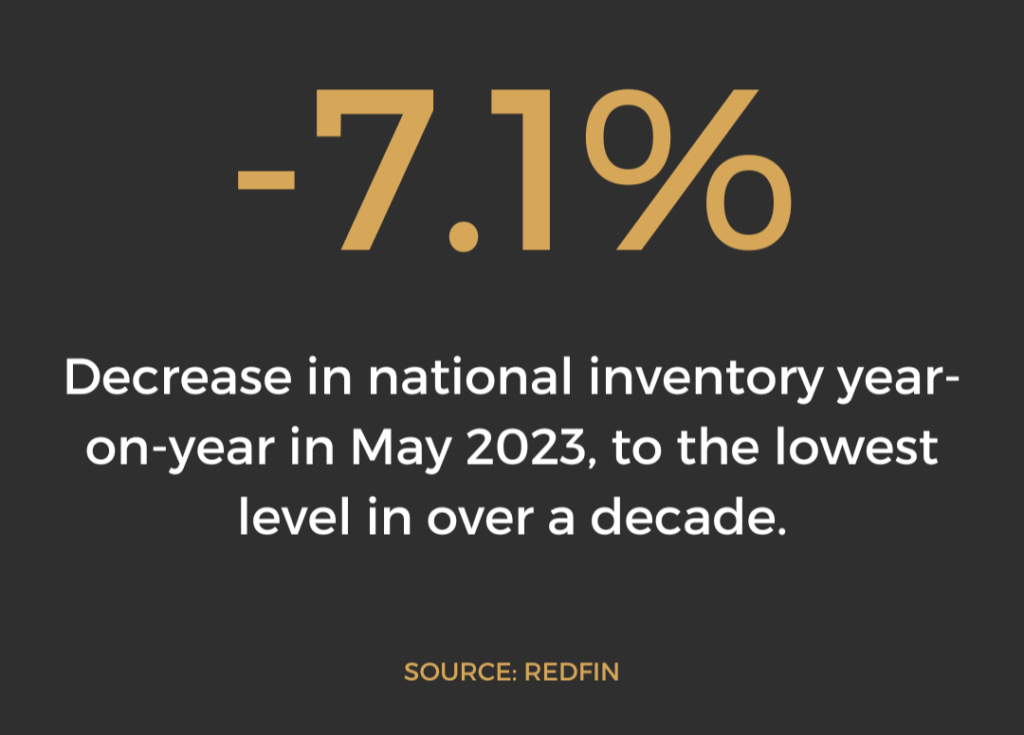

Think about this: Currently, 62% of households have rates lower than 4%! Consequently, inventory levels have dropped by 7.1% year over year (nationally). Why? Well, many homeowners are reluctant to let go of their homes due to their favorable rates, even despite potential life changes.

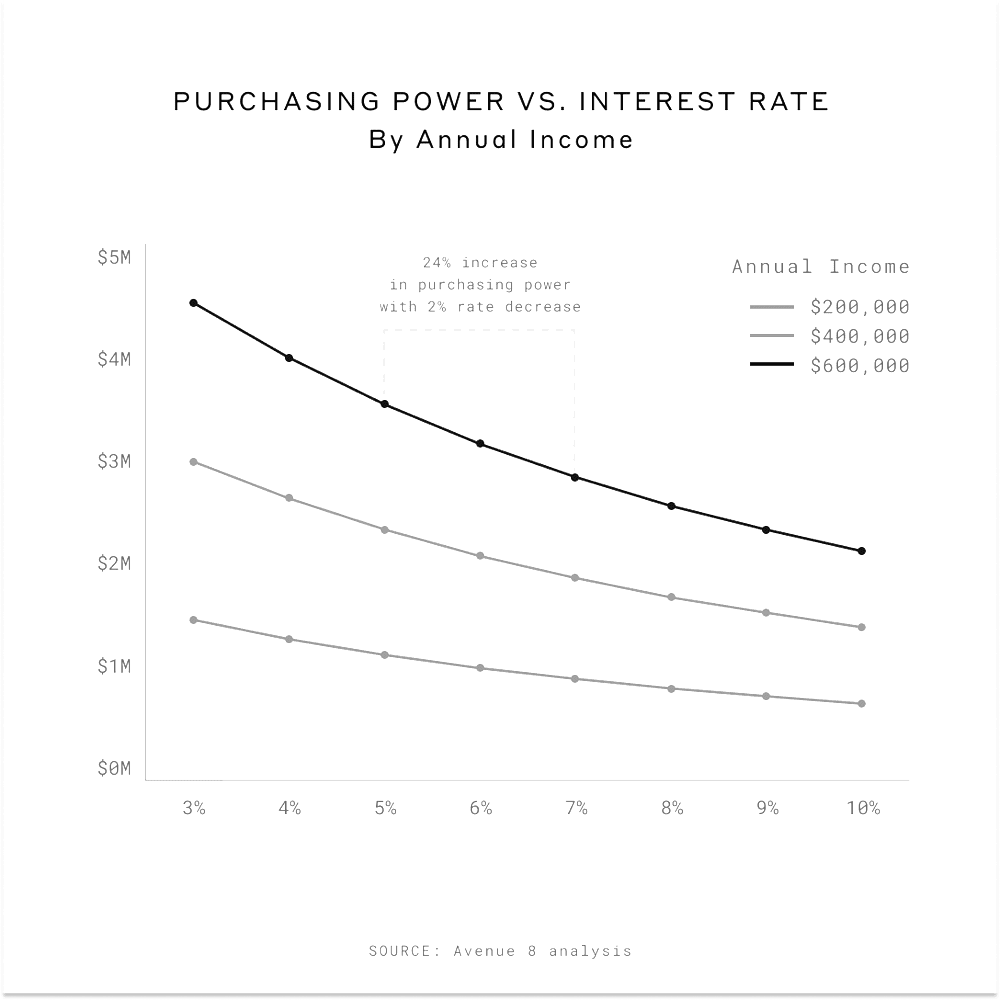

However, as rates approach the 5% mark, the leap becomes more manageable for homeowners, increasing the likelihood that they would finally sell and buy something else that better meets their needs. (*Cough, cough* Exactly what we saw in the pandemic when people suddenly decided that they needed more space, outdoor space, etc..)

To be clear, we don’t expect rates to be in the 2’s or 3’s again, but we do expect a significant enough fall that would reignite / “unlock” the housing market all over again.

So, the TL;DR (if you’ve managed to read this far): Most real estate experts (ourselves included) think that there will be a home buying frenzy again when rates get down close to 5%.

So, what?

For Buyers:

Well…If you’ve been considering a move (either buying and/or selling), it’s wise to keep a close eye on the situation and consult with us to seize potential opportunities that exist now – and in the coming months.

We said last Fall that it was a great time to buy, and it is looking like that was, in fact, the bottom of the market.

But, if you weren’t quite ready then…we have good news! The next best thing to buying back then is buying now. So, if you’ve been sitting on the sidelines, waiting for the perfect moment, now very might be your moment.

For Sellers:

We do not want to be those realtors who simultaneously say “it’s a great time to buy” and then follow it up with “it’s a great time to sell.” In fact, now might not be the best time to sell.

HOWEVER, as we’ve said in the past, there are so many nuances and it isn’t a one-size-fits-all. (Look back to last month’s newsletter for a deeper dive into some of the nuances). Here is the silver-lining for sellers – we have a lack of inventory now.

Once rates are down, we expect a lot more properties to hit the market. So, with some patience and strategic marketing, some sellers can absolutely use this now to their benefit.

As always, if you’re thinking about buying or selling…we’re here to help you look at the bigger picture, your broader housing goals, and educate you as to what might work best for you and your individual situation.