Hi there!

It’s been a little while! And, man – there’s a lot going on, including the media talking A LOT about the “housing bubble” and the fear of a “housing crash.” So, what’s going on, really? We have some answers for you and some important context…

A bubble is…

Let’s start with – “what is a bubble?” A bubble is the combination of overvaluation + speculation:

- Overvaluation: This does NOT just mean an increase in prices, but specifically, overvaluation of properties

- Speculation: This is what happened in 2008 – people buying homes they couldn’t afford and/or weren’t qualified for because they speculated that the housing market would rise at an unhealthy amount forever.

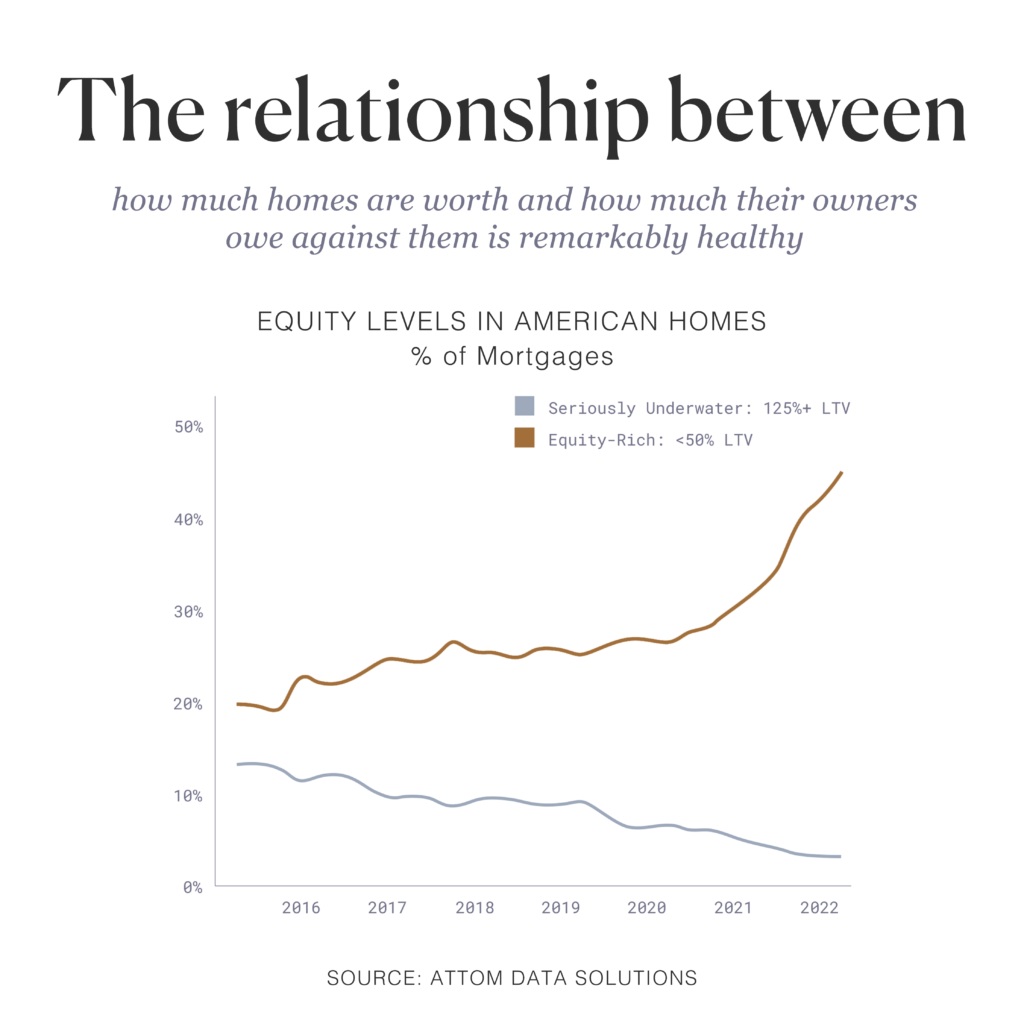

While some may argue that there is some overvaluation in the market in some places, there is nothing that indicates that the market has been driven up by speculation. Lending practices are insanely more strict and regulated than they were leading up to the 2008 crash; people have significantly more equity in their homes than they did in 2008 (see graph below). Where is speculation happening right now? (*cough* Crypto *cough* NFTs *cough*)

Now. . . let’s look at what drove the crazy housing market over the last two years

According to a new study by the National Bureau of Economic Research, remote work accounts for at least 50% of the record home price growth that’s occurred since the outset of the pandemic — as much as all other factors combined.

This is super important context for the present and future of the housing market, because those “other factors” that the study cites (like historically low mortgage rates, stimulus checks, and lockdown orders) are no longer with us. BUT, working from home is here to stay, at least in some capacity. And, with that, people need homes that accommodate working from home (i.e., more space), plus people have the ability to move around more freely – both within their current broader area (i.e., the Bay Area at large) and beyond. This should drive demand for upsized housing for years to come.

What’s more… the white paper from the study also specifically debunks the idea that the run-up in the housing sector is a speculative bubble inflated by buyers taking advantage of cheap money. Instead, it says that the demand was genuine, driven by a revolutionary shift in the economy that is only getting started.

So, what do we expect to happen moving forward?

From the April numbers, it appears that the housing market is starting to somewhat cool. NOT crash. Cool. Inventory is incrementally rising (still constrained, but rising). In April, 20.2% of sellers in San Francisco did a price reduction (compared to 13.9% in 2021). From what I’m personally seeing, this is a sign that sellers are adjusting to “the new normal” – not being overly greedy, but realistic. Homes continue to sell quickly in the Bay Area – in an average of 13 days in May 2022 (vs. 14 days in May 2021).

HOWEVER. . . for the past two years, furious buyer competition has deterred homeowners who were ready to move (but not desperate) from entering the market. Who wants to leave their comfortable roost only to join a game of musical chairs in which there are dozens of more desperate players fighting for each seat?

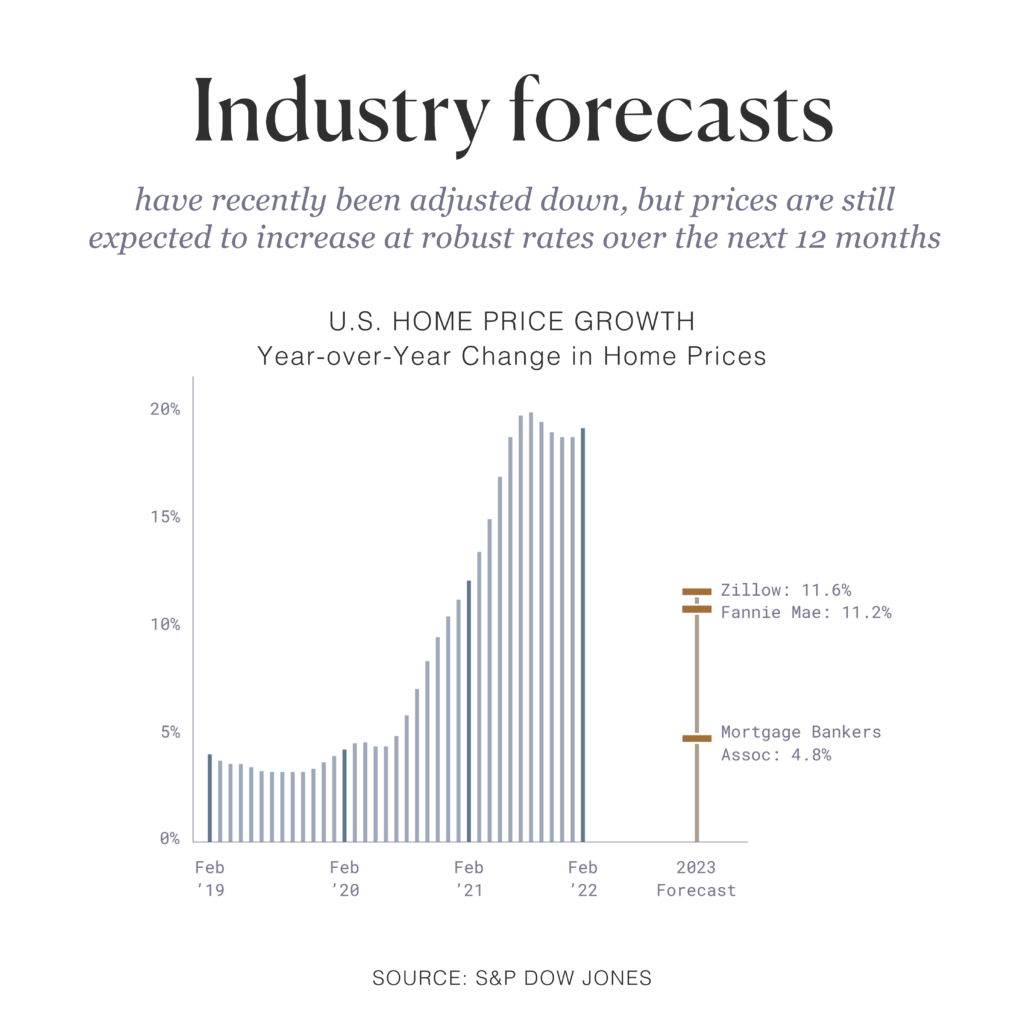

But rising mortgage rates, along with inflation, have altered the contest in a way that favors those who are trading one house for another. Seller-buyers borrow much less than first-timers, meaning they’re less affected by interest spikes. And most sellers will immediately plow all of their rapidly depreciating cash directly into an asset — their new home — that’s still expected to appreciate robustly over the next 12 months (see graph below). AKA: sellers will sell and move around, thereby opening up some inventory.

Overall, the imbalance of supply and demand will continue to drive the market, just not at the kind of crazy numbers that we saw over the last 2 years. Right now, across the entire country, there are only ~163,000 homes under construction. Yet, there are millions of millennial and Gen Z buyers entering prime home-buying years. Plus, in California, legislation like Prop 19 (which is finally getting ironed out) is designed to help encourage boomers to sell their homes (usually bought by millennials families) and move to a more appropriate sized home for this stage of their life.

So, will prices continue to rise? Yes, I 100% expect them to.

Will they rise by 20-30% YoY? No, but even an average of ~11% YoY for a home where you live (read: get daily value from) and/or get passive income from is still pretty darn good!

Questions? Thoughts? If you ever want to chat more about any of this, I’m just a phone call away! Remember to check out my Instagram for real-time market insights and updates!

Happy Summer!

Blakely