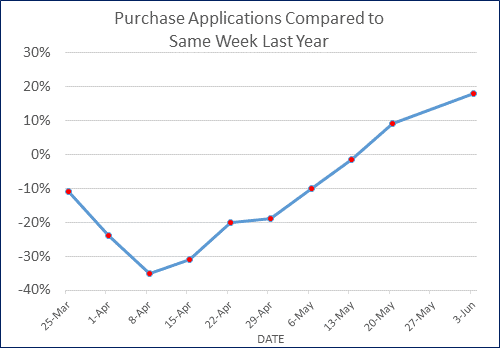

Purchase applications were up 18% compared to the same time last year and up 6% from a week ago, according to the Mortgage Bankers Association‘s Weekly Mortgage Applications Survey. This gives us two back-to-back weeks of positive year-over-year prints for purchase applications in the final weeks of the typical housing market heat months.

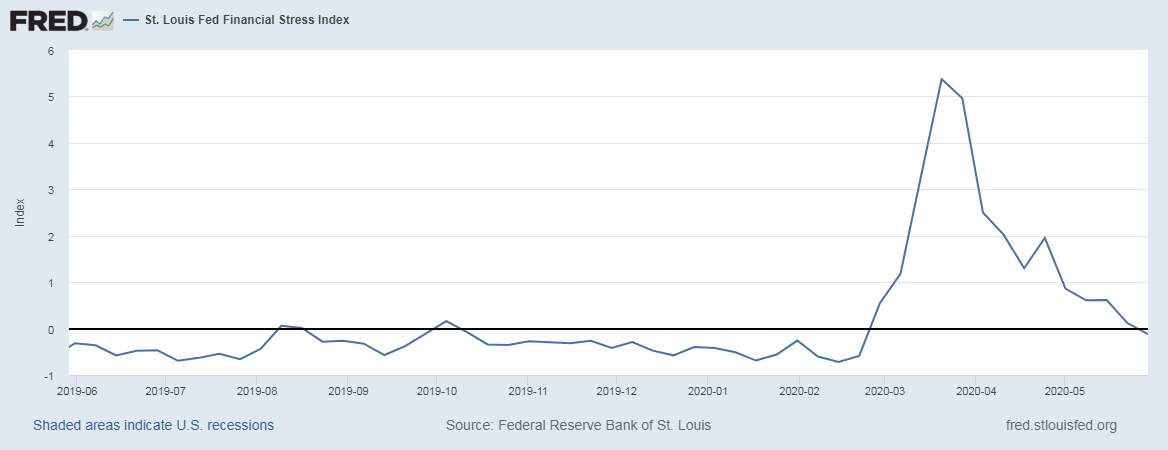

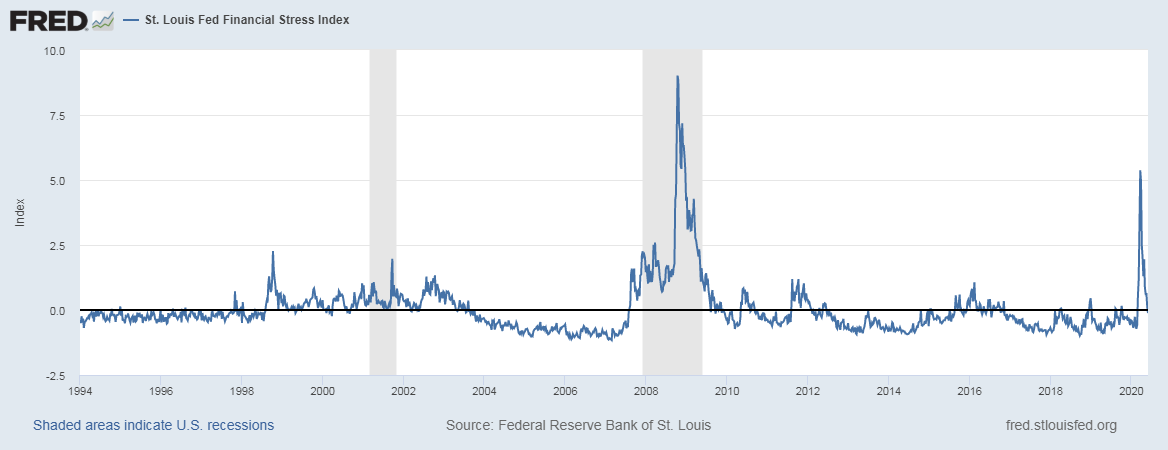

It’s not a coincidence that the “V-shaped” recovery in purchase applications (first graph, data sourced from MBA) is mimicked by the inverted “V-shaped” recovery of the St. Louis Stress Index (second graph). This indicates a return to a much more calm financial market.

The St. Louis Financial Stress Index, in case you are not familiar, is calculated from the weekly averages of seven interest rates, six yield spreads and five other bond and stock indices. The goal is to provide an overall financial stress metric for the stock and bond markets.

This index going to zero or below is one of the five metrics that I identified as reliable indicators that the American economy was emerging from the AD stage (after the disease) to AB stage (America is back).

The stress index is designed so that under normal financial conditions it is zero. It goes positive when the markets are contracting and negative when the markets are acting much better.

On Friday, May 29, the stress index went negative for the first time since Feb 21, 2020. The latter date was just days before the U.S. reported the first COVID-19 related death. As we can see below, this index had a massive spike during the Great Recession as well and then came back to below zero.

When the stress index goes below zero and stays there for some time, we will know that the economy is in recovery mode and we can expect other indicators to improve like jobless claims in time.

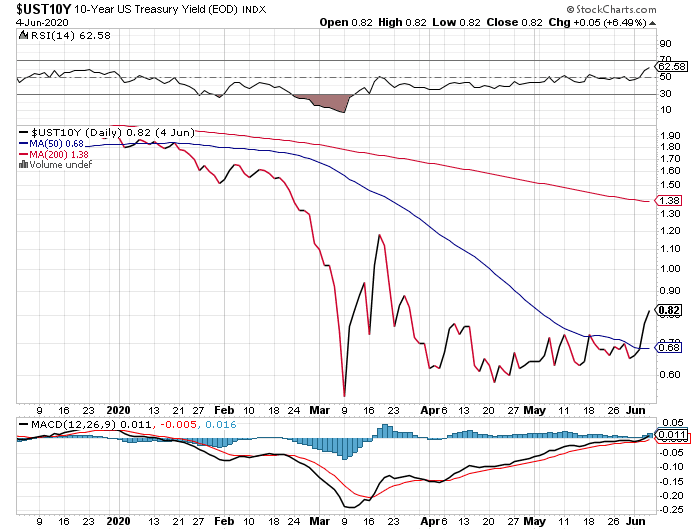

Today’s job’s report showed a gain of 2.5 million jobs, and the 10-year yield jumped to 0.94% on that data.

Both the increase in purchase applications and the fall of stress index are good for the housing market. But, if the economy reopens successfully without any virus rebound news, we may have already seen the lowest lows in mortgage rates.

One of the other five things we need to see en route to recovery is the 10-year yield go above 1%. This means the economy is doing better and we really want to create a new range between 1.33%-1.6%.

Currently, at 0.9% we are still far from those levels. But recently, the 10-year yield has shown some signs of life of wanting to go higher.

We still have a lot of high-risk variables, such as an increase in new cases that might put our hospitals at risk, unnecessary lack of financial support by the U.S. government, more bad China trade war or retaliation headlines and even a pullback in the stock market can drive money into bonds. So we still have many pitfalls.

But if I am right, and we are going into the recovery stage, the next two things we should see over the next six months is the 10-year yield going above 1% and jobless claims stopping its horrific rise.

Here’s the 10-year yield as of the close on June 4:

All in all, the good news is that purchase application data is positive year over year, the St. Louis Financial Stress Index is below zero and today’s positive print in the jobs report.