In Recovery?

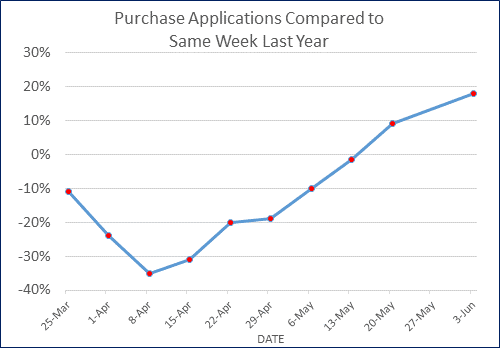

Things are certainly picking up: Mortgage applications have increased dramatically. and inventory levels are on the rise. However, prices aren’t falling that trend in all cases. (Great for buyers!) We’re seeing an average of 1-4% over the asking price (vs 20-30% in many cases in the past)! This does vary property-to-property, and if you ever need help navigating pricing or the right offer strategy to win, you know who to ask! 🙂